Table of Contents

Post Covid-19 era, new normal, hybrid workstyle, new stay-at-home world, and remote workplace; these terms have been discussed repeatedly in the past two years. Eventually, for publishers and advertisers, it all came down to customer behavior and how this new routine will affect them — everything from everyday shopping and spending habits to entertainment patterns — shifted rapidly. TV viewing stretched, and it got propelled by augmented streaming and on-demand viewership. Connected TV advertising companies, connected TV advertising platforms, and CTV advertising experienced a massive soar in revenue and user consumption.

The connected TV penetration rate in the US rose to an all-time high in 2021, with 82% of American households owning at least one internet-connected TV device. It’s evident from a customer/user perspective the new normal in the television world has settled in, and the tipping point has passed. Online streaming and OTT platforms are simply becoming identical to conventional television viewing for most Americans.

Linear television continues to play a vital role; however, overall linear viewership declines as customers or users abandon the Pay-TV subscriptions. The global television market revenue increased in 2021 to almost 180 billion US dollars. However, the Statista Consumer Market Outlook estimates that the worldwide TV revenue will decrease in 2022 to around 173 billion dollars before slowly increasing over the following years. By 2026, revenue will be at approximately 178 billion dollars.

Nicola Teague, Head of AV, the7stars rightly indicated how the lines between TV and digital are blurring; she expressed, “the pandemic has resulted in many monumental shifts in society. One such shift has been the accelerated change in video content consumption. Conversations have moved away from ‘the death of TV’ and on to the evolution of broadcast content viewed through TV screens.

YouTube has seen time spent viewing the app via TV screens more than double year-on-year. Over 25 million people now watch YouTube on their TV, meaning we can reach large viewers watching high-quality YouTube content in their living rooms. While still in its infancy, CTV has seen huge growth, providing great opportunities to access broadcast-quality content through a digital and programmatic buy. And now, Amazon’s IMDb TV streaming service has just joined the UK landscape, offering free content with pre-roll and mid-roll ads that allow AV buyers to use a wealth of different targeting, including a person’s shopping habits or basket contents.

The lines between TV and digital are blurring. A cohesive AV plan needs planners that are equipped to plan and buy across multiple different platforms. AV is no longer just about linear and BVOD. YouTube, CTV, and IMDb TV all provide great opportunities to expand reach, explore new levels of targeting and reporting, and are accessible to a broader range of clients with varied budgets. All of these points mean that TV can be used for a multitude of client KPIs.”

Today, we are talking about a surge of groundbreaking thinking and prompt turnaround of monetization solutions – Connected TV (CTV), which will eventually help publishers better monetize and give their audiences better brand access in an appropriate, efficient manner in the post-pandemic era.

The ‘cordless viewer’ is becoming the primary TV consumer – millennials and iGen are only moving further away from conventional TV habits as streaming distribution gains momentum. IAS released a ‘Streaming War’ report – discovered that younger audiences, precisely, have inclined towards CTV with 58%, users between 18-29 age group are fancying it now, compared to 43% the previous year. So, what is CTV? What is connected TV advertising? What are the connected TV advertising platforms? Why should publishers pay attention to connected TV programmatic?

What is CTV?

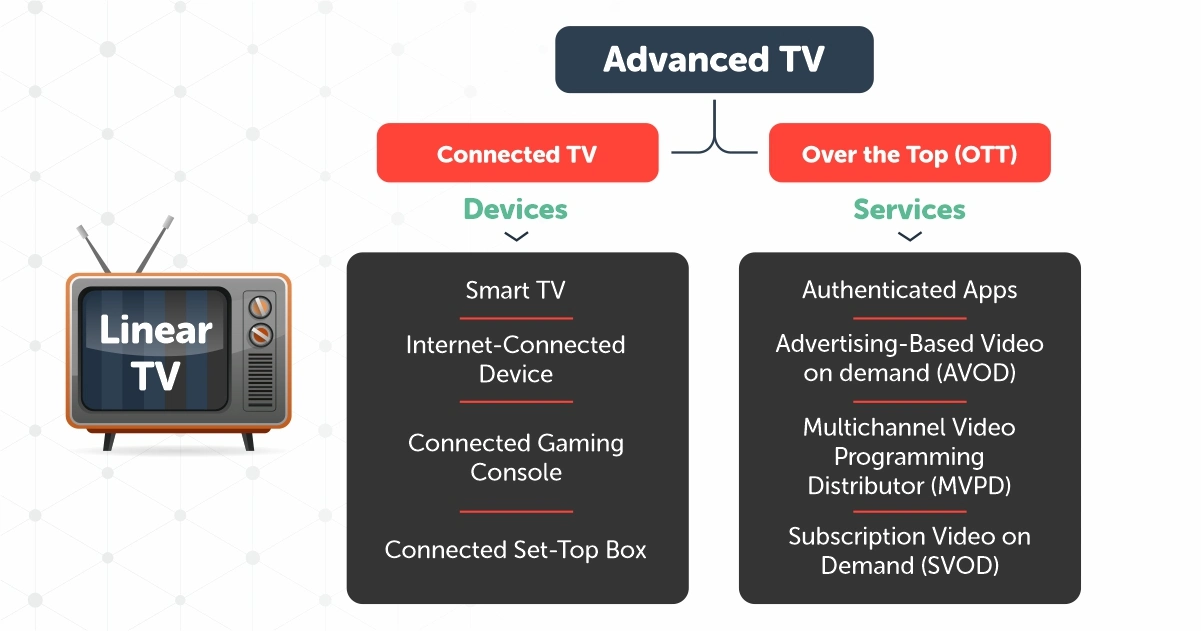

Connected TV (CTV) can be referred to as any TV or television connecting to the internet – Smart TVs. Even conventional TVs can get connected to the internet with the help of a supporting device (a smartphone, Amazon Fire TV Stick, Apple TV, Roku, or similar streaming service). Nowadays, viewers can use gaming consoles like Xbox and PlayStation to turn their television into a connected TV.

Lately, CTV is often used interchangeably with OTT (over-the-top) video service; however, there are some deviations between the two. Connected TV is reserved only for TVs that connect to the internet, and OTT deals with several contents that can be streamed via TV, smartphone, tablet, or other devices. As per the recent data, US upfront CTV video ad spending will increase by 49.5% this year to $4.51 billion. As the industry regulator for digital advertising, IAB crafted a guide to the Connected TV Supply Chain in partnership with the IAB’s Connected TV Advisory group to stipulate an overview of the CTV programmatic supply chain and the distinctive CTV options.

What is Connected TV Advertising?

We hope by now you have a better understanding of the term CTV. Let’s jump into another tricky question and find out – what is connected TV advertising? As you know, connected TV means premium content streaming via apps, either smart TV or OTT (over-the-top device). Here comes the advertisement part, ads are served before content or during conventional commercial breaks. These ads are placed on any devices or TV connected to the internet and access video streaming content outside what is available via the standard offering from a cable provider. Connected TV advertising is one of the fastest-growing marketing methods, especially in the USA, the main aim is to reach cord-cutting households.

Let’s look at the Chief Revenue Officer, Sojern, Noreen Henry’s statement on ‘CTV is the answer to brand awareness and engagement.‘ She mentioned, “CTV soared in popularity during the pandemic. According to eMarketer, US adults spend 2 hours and 29 minutes per day viewing digital video in 2021. Additionally, US upfront CTV video ad spending is predicted to be one of the fastest-growing digital ad channels this year, increasing by 49.5% to USD$4.51bn (£3.38bn). IAS found that Australian viewers’ habits also indicate that CTV ad experiences were preferred, and 74% of Australian consumers use their CTVs to watch ad-supported programming, particularly on YouTube. Streaming services are becoming increasingly popular and, as more consumers cut-the-cord, CTV has become the industry’s answer to increasing brand awareness and driving engagement.”

Varieties of CTV Ads

OLV or Online Video Advertising is an umbrella term for all online video advertising, including in-stream ads, pre-roll, and mid-roll ads, outstream, and home screen display ads.

- In-stream video ads: These are placed sporadically throughout a TV show and users can skip these in-stream ads; hence, they are a great way to repurpose conventional TV ads

- Interactive pre-roll ads: Like in-stream video ads, interactive pre-roll ads are played at the start of the video content. It also includes the option for the viewer to click the ad and directly go to a landing page to buy the goods or services the advertiser offers

- Outstream Video ads: These are displayed outside of streaming video players

- Mid-roll ads: These ads are the part of in-stream ads shown in the middle of any ongoing video content

- Home screen ads: These ads sit on the main display page of a connected TV before the user clicks to watch a specific program or series. It can be a form of a video or image and may include a particular CTA

- Post roll ads: These ads are the part of in-stream ads shown at the end of the video content

The Supply Chain of CTV

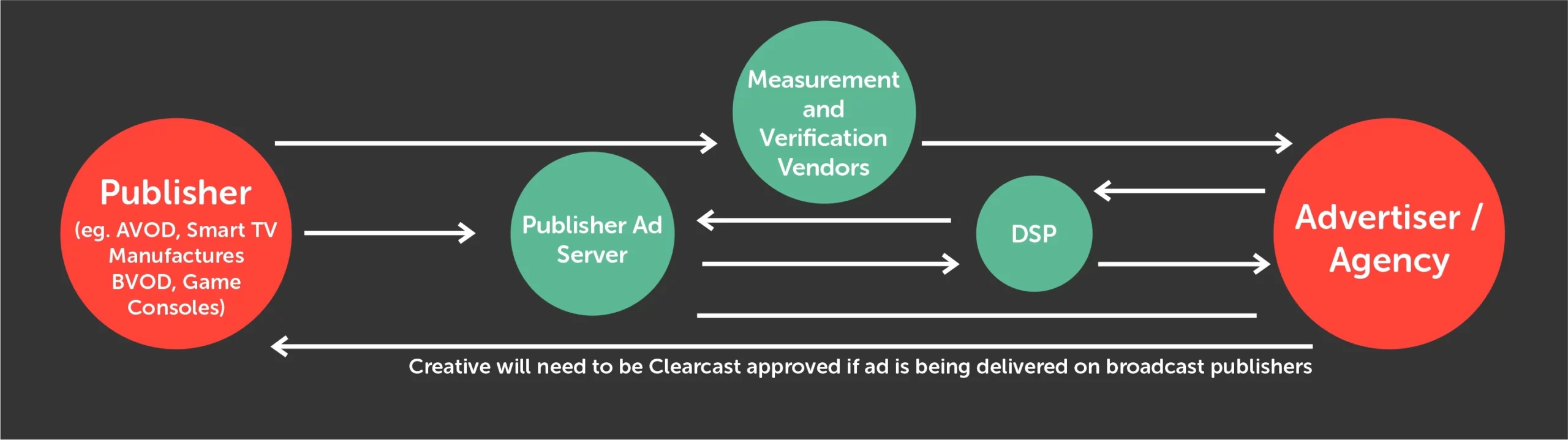

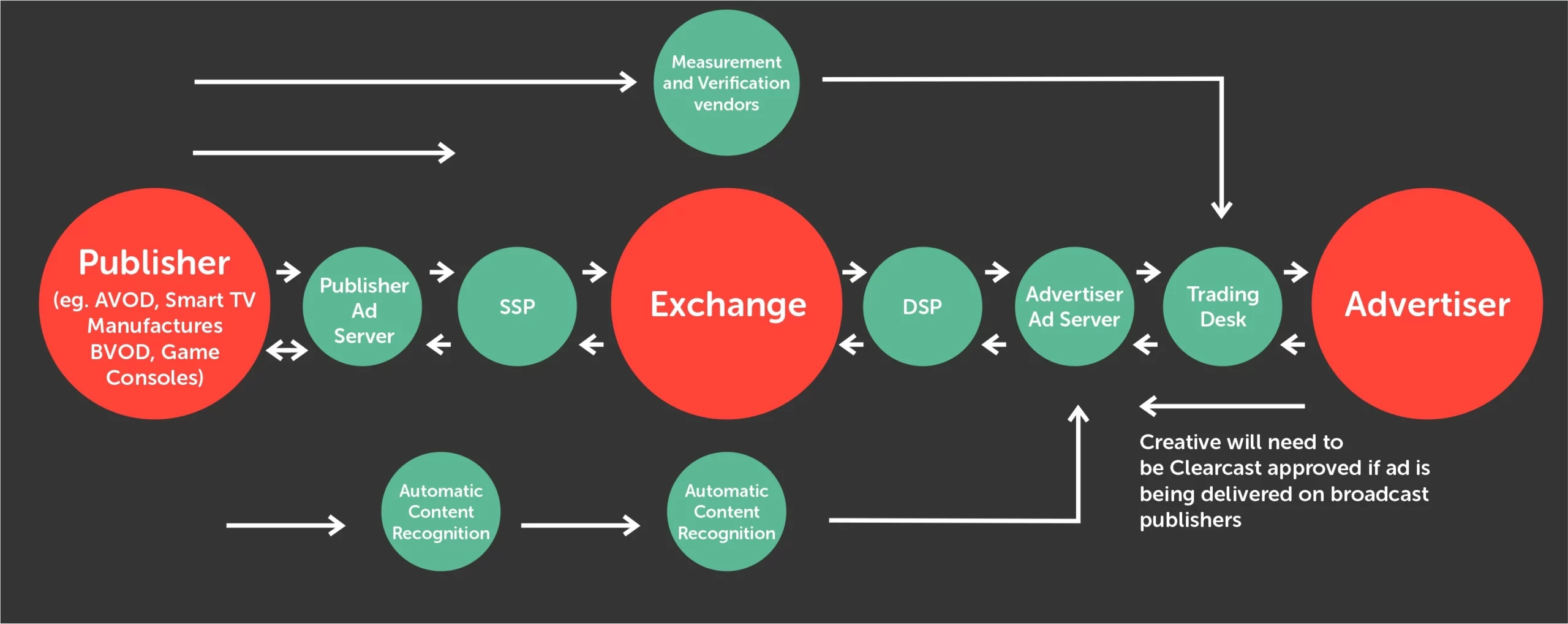

There are two leading ways of buying CTV.

The CTV Supply Chain Direct Buy: Buying directly from a supplier.

The CTV Supply Chain Programmatic Buy: Buying programmatically via a trading desk.

Why is Connected TV advertising beneficial for Publishers?

Over the last year, publishers have been inundated with the buzz around connected TV (CTV). In the context of this article, a publisher can be referred to as CTV content publishers, such as BBC iPlayer, Amazon, Netflix, and Sky. Or CTV-first publishers native to the CTV space, who don’t have a presence in the linear television world, such as Roku and RakutenTV. Also, CTV channels, web/mobile publishers, and virtual MVPDs. Amidst thriving audience engagement — the post-pandemic era boosted viewership in 2020 as lockdowns led to people having more time to watch the video. YouTube CTV viewers grew almost 63% last year and surpassed the 50% threshold for the share of viewers who watched YouTube content on CTVs. Over 60% of US YouTube viewers, ie., 140.1 million viewers, will watch the platform’s content on CTVs by 2024. Hence, the buy-side enthusiasm for reinforcing the campaign exposure and ad interaction has soared.

Plus, there is a rising awareness of the scope for linear-centric broadcasters to evolve their models and boost online revenues. However, focusing on how the CTV explosion can benefit broader digital media owners is still in the infancy stage. Most publishers are familiar with the influence and lucrativeness of video. Yet, the CTV space is relatively unspecified and uncharted territory for now.

As third-party cookie deprecation, browser constraints, and keyword blocking continue to impact publishers’ revenues, moving towards CTV could help publishers unlock better revenue growth and monetization returns. First, as a publisher, you need to understand the key opportunities and vital challenges.

Let’s unpack the bundle and see how publishers can make the most of CTV:

- Value and Leverage First-party data:

Publisher first-party data are not fully engaged or underused. When it comes to CTV, publishers have exclusive insight into what viewers/users are watching, when, and how often they are watching. When the data is extracted in a privacy-compliant manner, this data is essential for effectively wrapping and selling valuable CTV inventory.

Insight into user behaviors and preferences allows publishers to generate audience segments and streamline the buying process for their specific advertisers. Moreover, publishers can work directly with advertisers to access advertisers’ first-party data and match it to their own data for improved accuracy.

Lastly, publishers who work with third-party partners with audience management capabilities and integrations usually witness an increase in yield by having more profound insight into buyer performance metrics and the ability to optimize as required.

- Without a doubt, embrace the big screen:

Among the most recognizable advantages of tapping into CTV is the expanded audience reach. Users started migrating away from the conventional media well before COVID-19, and now the shift is rising. The switch to an online-first lifestyle has amped up the demand for numerous digital entertainment and information sources, CTV included.

Since the pandemic, nearly half of global users have increased their consumption, pushing CTV with the 47% spike in digital content and news. Hence, it effectively made CTV an essential outlet for media owners who are seeking to maximize audience attention. Similarly, CTV presents valuable yield-boosting prospects with alternative revenue streams, especially subscriptions. The cookie-less CTV milieu appears to produce alluring opportunities for publishers to reinforce video monetization using their own first-party data and contextual insight.

- Complete programmatic optimization:

CTV is still in its infancy stages of developing effective optimization for programmatic inventory. As a publisher, this inception stage will lend you multiple opportunities to streamline the process as though it’s brand new. Operating with a partner who can hold an integrated and unified auction can help drive efficiency, transparency, and optimization through the programmatic buying and selling process. Unified auctions will help publishers to offer inventory to multiple ad exchanges, eliminating the burdensome need to participate directly into an ad server, resulting in boosted yield for publishers.

Andrew Tu, Managing Director, APAC, OpenX, clearly stated, “Audiences have embraced on-demand video streaming, and this is a trend that was accelerated by the pandemic. Research predicts that the population of digital video viewers in APAC is slated to surpass 2 billion viewers in 2022, and from an advertising perspective, emerging platforms like OTT and CTV, which offer scale and precision in reach, will be competing fiercely with traditional television for a share of ad budgets. Looking at the subset of CTV/OTT, however, we are still seeing higher ad spend on mobile as compared to CTV. APAC has a more mobile-first population than other parts of the world, and in fact, nine out of ten viewers in the region use smartphones to stream videos. We expect dollars to continue shifting away from linear TV in 2022, but we also expect this to continue to over-indexing to mobile video, as opposed to traditional CTV.”

Future of Connected TV Advertising:

We can see that CTV has reached its omnipresent status quo, and it will continue to thrive in the future. The Leichtman Research Group’s recent study shows 39% of all adults watch video daily via a connected TV device. Weekly data shows higher results – 60% of adults watch video using a connected TV device at least once a week, compared to 59% in 2020. If you carefully study all the stats and facts mentioned in this article, you will clearly see that as publishers, you have an exceptional prospect to forge a new path and optimize for enhanced revenue.

As a publisher, if you are willing to think ‘inside the video,’ there are outstanding opportunities for you to claim your share of CTV rewards too. Expanding CTV offerings will help publishers expand the content reach and plug into the strong-growing demand for resourceful digital content, resulting in captivating higher investment on the way.

Effectiveness and implementation are the keys here. Ensuring the right strategies and technology partners will lead you towards success. AdSparc’s next-generation monetization solution offers publishers robust analytics, unique opportunities, high service level, technology knowledge, proprietary tech, and exclusive monetization strategy. AdSparc being an official Google MCM partner, means that as a publisher you can maximize revenue potential, increase bid density on ad inventory, entice more premium buyers, expand the rate of ad inventory, obtain access to the highest standards of ad quality, and video monetization. By securely optimizing video-level data, granular data reporting, you can unlock the doors to countless attention and revenue. If you want more insight, feel free to contact us!

Frequently Asked Questions

What is Connected TV?

Connected TV (CTV) can be defined as any TV or television connecting to the internet – Smart TVs.

How can you convert traditional TV into Connected TV?

Traditional TVs can get connected to the internet with the help of a supporting device (a smartphone, Amazon Fire TV Stick, Apple TV, Roku, or similar streaming service) and turn into connected TV.

What is Connected TV Advertising?

Ads that are placed on any devices or TV connected to the internet and access video streaming content outside what is available via the standard offering from a cable provider.

What are different types of Connected TV Ads?

There are multiple CTV ads, such as in-stream video ads, pre-roll ads, post-roll ads, and home screen ads.

What are the benefits of Connected TV Advertising for Publishers?

Publishers can extract privacy-compliant first-party data and effectively wrap and sell valuable CTV inventory. Publishers can expand their audience reach, and unified auctions will help them to offer inventory to multiple ad exchanges.

Also Read: What are Rich Media Ads? How are they different from other ad formats?